SaaS Development - Financial Planning Software

Digitalising (SaaS) a Complex Financial Model & Building a Feature Rich, End-to-End and AI Customised User Journey

This SaaS platform is designed to empower Australians to enhance their wealth and achieve their most important life goals. It seamlessly combines the convenience of online tools with access to a licensed wealth coach, providing expert guidance on everything from budgeting and to investing and retirement planning.

Focus Area:

- Financial Planning

- Wealth Management & Understanding

- Life Goal Planning

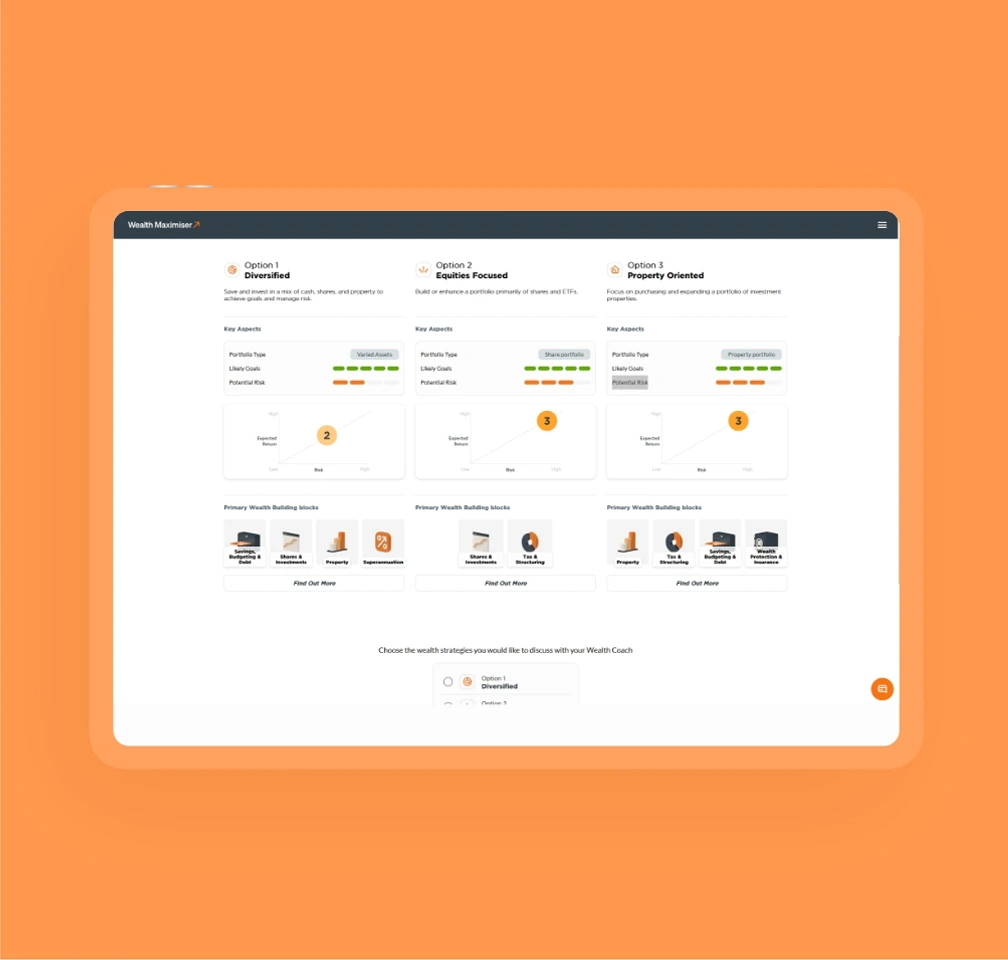

- Establishing a Strategy & Action Plan

- One-to-One Wealth Coaching

Features

- In Depth Financial Questionnaire

- Wealth Health Scoring

- Complex Backend Financial Model Calculations

- Goal Likelihood Scoring

- Strategy & Action Planning

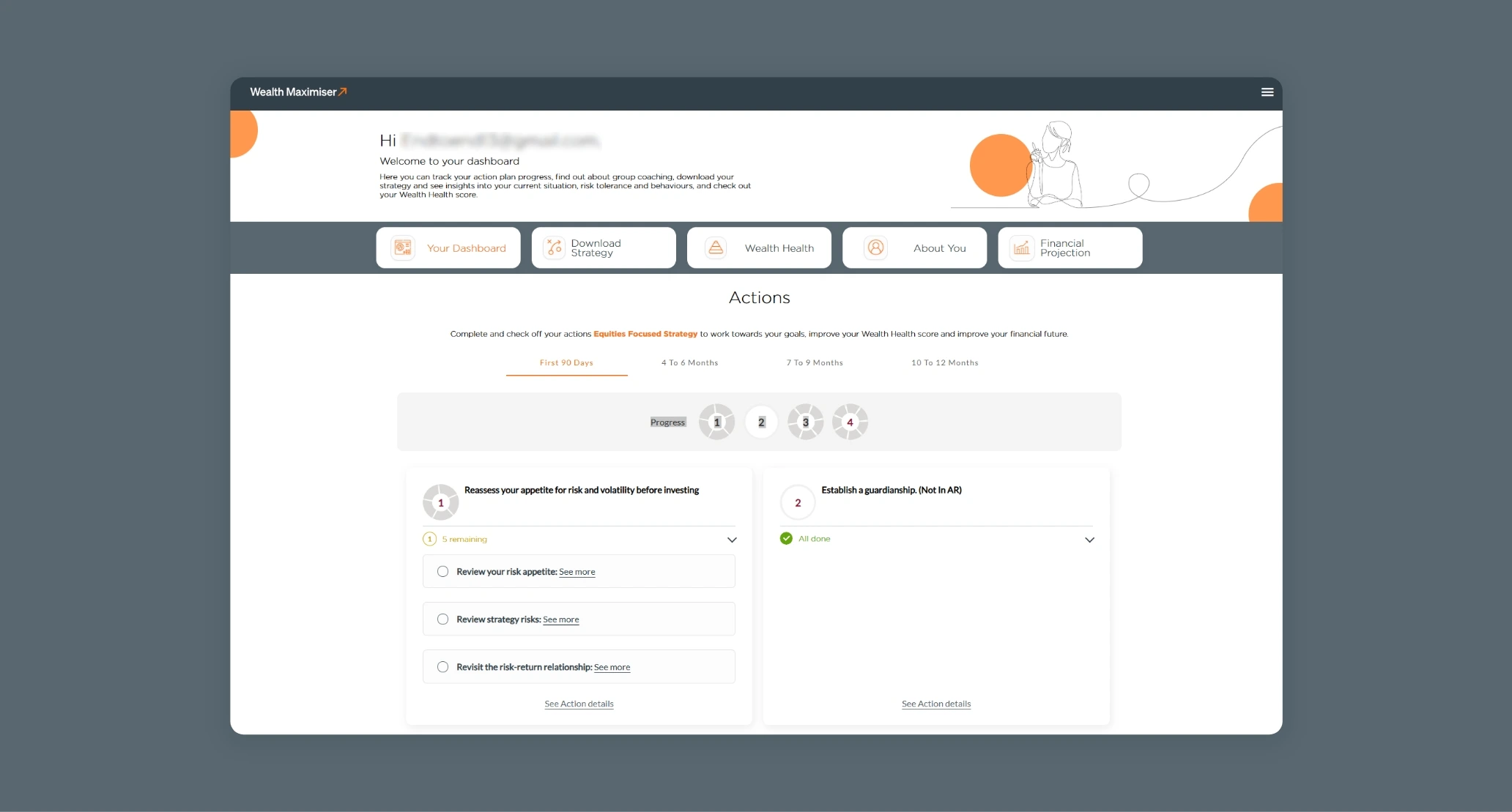

- Action Tracking Dashboard

- PDF Report Generation

- Feature Rich Admin Portal Management

- One-to-One Wealth Coach Meetings

Project Duration:

12+ Months & Ongoing

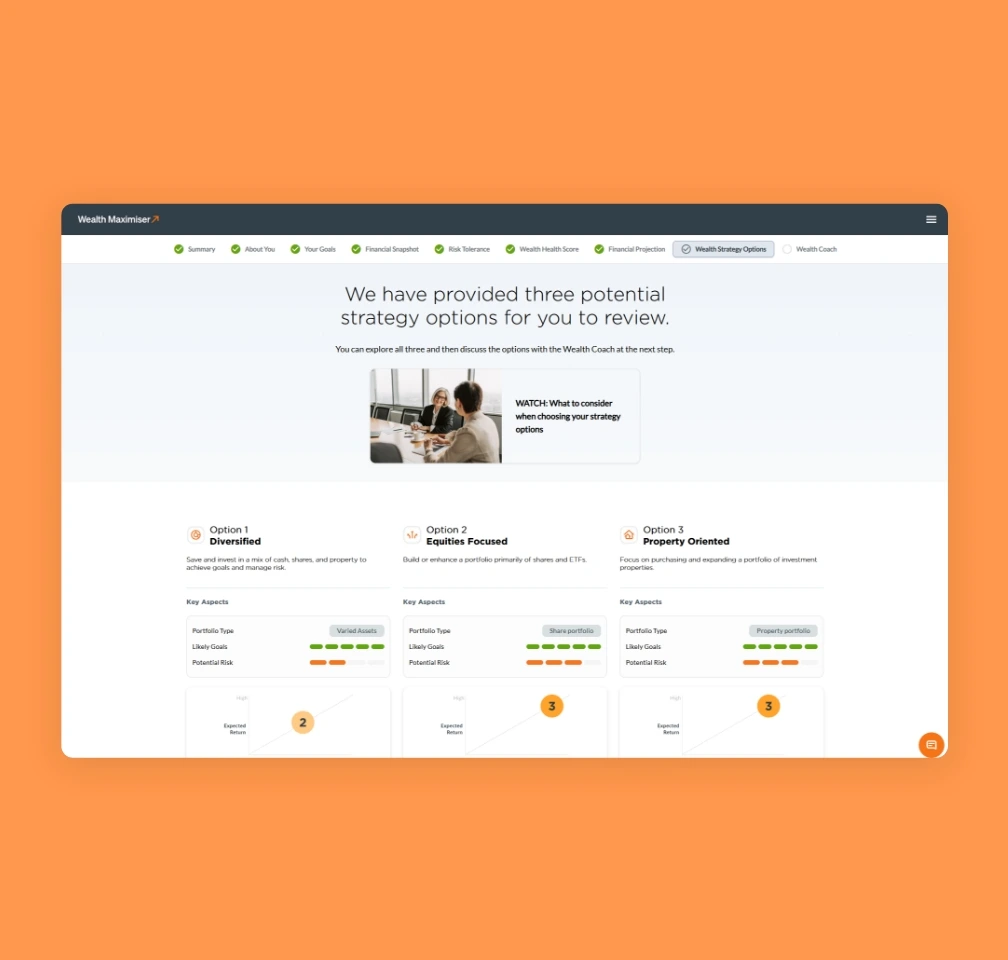

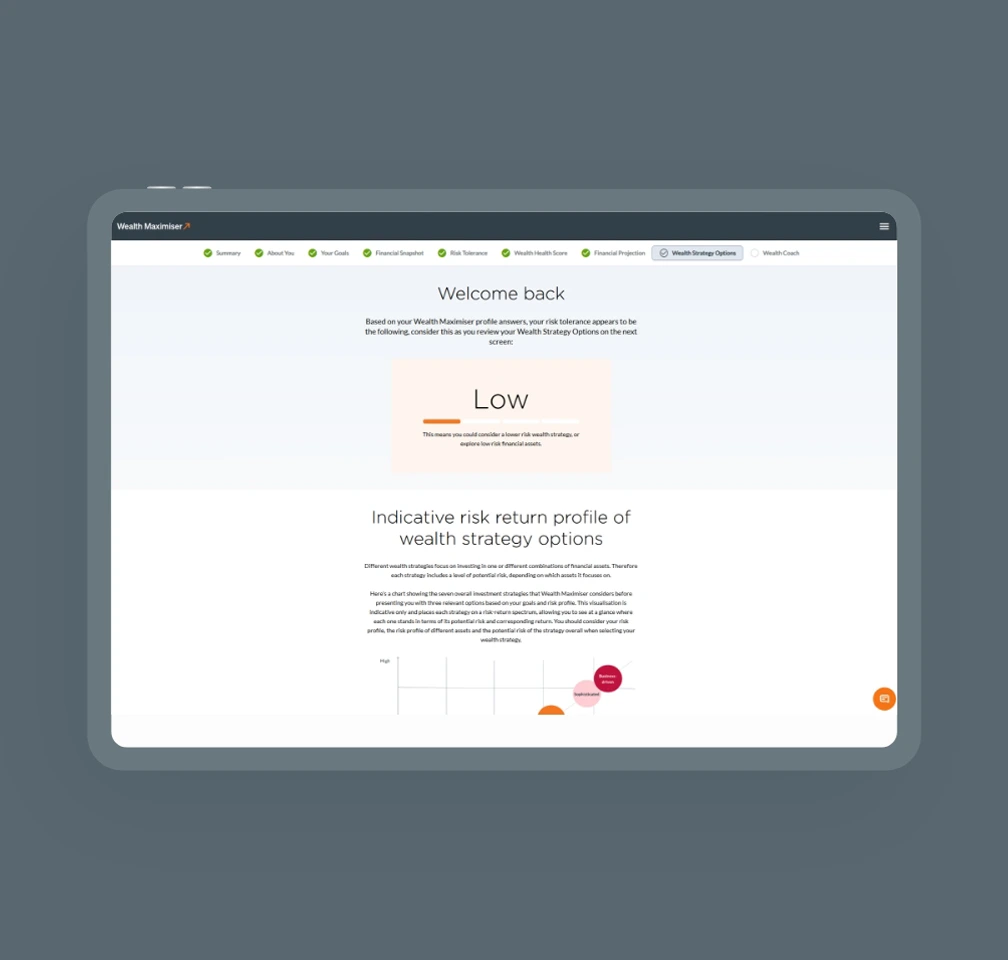

Users begin by completing a detailed questionnaire, which generates a visual outlook of their financial future, calculated from the backend model. After selecting a package and making a payment, users can book timeslots with their wealth coach, who will review, update, and recommend wealth strategies tailored to their specific goals.

Artificial Intelligence powers the creation of personalised action plans, ensuring that every user’s journey is unique. These plans cover a 24-month period, with the first 12 months divided into quarters, aligned with wealth coach meetings. The platform also includes an action tracking dashboard and downloadable files, offering a comprehensive financial planning infrastructure for individuals and couples focused on building wealth.

Project Challenges

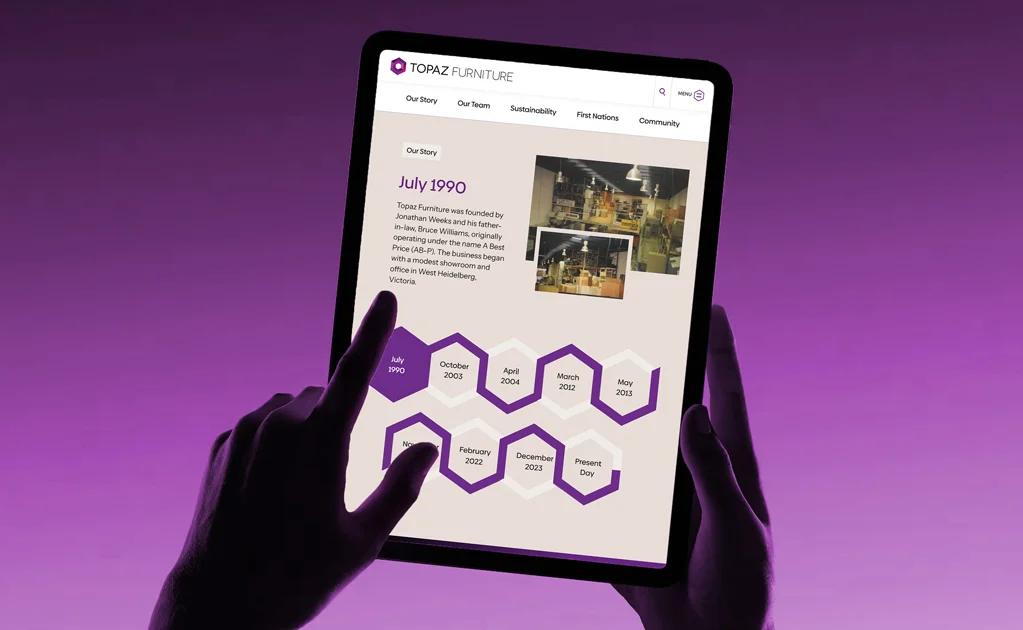

Our team, collaborating and utilising our diverse skill sets, successfully reverse-engineered a complex Excel model consisting of over 80 sheets, some containing more than 1,000 rows, along with Excel macros. The Excel workbook was over 25MB in size. This Excel sheet was our only reference for understanding the functionality required for the SaaS model, which posed challenges in fully grasping the model without a specifications document.

Through thorough investigation, testing, and analysis, we started to uncover the inner workings of the model, transforming it into a software development architecture. By decoupling dependencies, we laid the groundwork for a robust foundation that supports future growth and expansion.

During model investigation & testing, our team identified calculation discrepancies within the model and improved its accuracy during development by updating key macros and algorithms. This ensured more reliable outputs and reinforced the client’s confidence in our understanding and dedication to the businesses core offering.

Project Team

Wealth Planning Model

The wealth planning model accounts for a wide range of financial considerations to gain a comprehensive understanding of the customer’s financial situation, including:

Assets

- Cash Savings

- Properties (PPOR & Investments)

- Investment portfolio (Shares,Bonds, REITs & ETFs)

- Motor Vehicles

- Superannuation

- Home Contents & Miscellaneous

Liabilities

- Property Loan (PPOR & Investments)

- Motor Vehicle Loan

- Student Loan

- Credit Card Loan

Expenses

- Lifestyle Expenses

- Loan Repayments

- Tax Deductions

"Through thorough investigation, testing, and analysis, we started to uncover the inner workings of the model, transforming it into a software development architecture. By decoupling dependencies, we laid the groundwork for a robust foundation that supports future growth and expansion.”

Want to understand the scale of this enterprise application?

In close collaboration with our client, we released multiple software versions into production after thorough testing, ensuring outcomes were consistent with the Excel model. We provided ongoing production support and applied hotfixes as needed. By successfully digitising their complex Excel model, we significantly enhanced scalability and delivered a strong Return on Investment (ROI). The success of the product launch has also enabled the client to form valuable business partnerships with other large multinational companies.

Technologies Stack

Frontend

Backend

Hosting & Tools

Integrations

Key Project

Considerations

This project required thoughtful planning to accommodate business requirements while reverse engineering a complex financial model. Our team understood the complex model and completely transformed it into a user-friendly SaaS platform.